- Focus

- Posts

- 81% of Troubled Businesses Choose Liquidation: Here's Why That Number Should Concern You

81% of Troubled Businesses Choose Liquidation: Here's Why That Number Should Concern You

Sponsored by PublicSectorExperts.com

Hey there👋

The Hard Truth Behind the Numbers

We've all heard the sobering statistics about business failure rates. But what happens when businesses actually hit that financial wall? For years, policymakers have been crafting legislation with the admirable goal of helping struggling companies survive. But the data tells a different story about what's happening on the ground.

Research by Andrew Keay and Peter Walton examines corporate insolvency statistics in England and Wales from 1960 to 2022. Their paper, "Companies, Damned Companies and Statistics -- Corporate Insolvency Through The Years: Have We Got It Right With The Existing Regimes?" measures whether insolvency systems deliver their intended results.

The Rescue Gap: Expectation vs. Reality

Since 1986, UK law has offered various options for companies in financial distress. The introduction of administration and Company Voluntary Arrangements (CVAs) was specifically aimed at giving businesses alternatives to liquidation – ways to restructure and survive rather than simply close down.

But here's the reality check: despite these alternatives, liquidation remains overwhelmingly the most common outcome for struggling companies. Creditors' Voluntary Liquidation (CVL) has consistently dominated the insolvency landscape across all time periods studied.

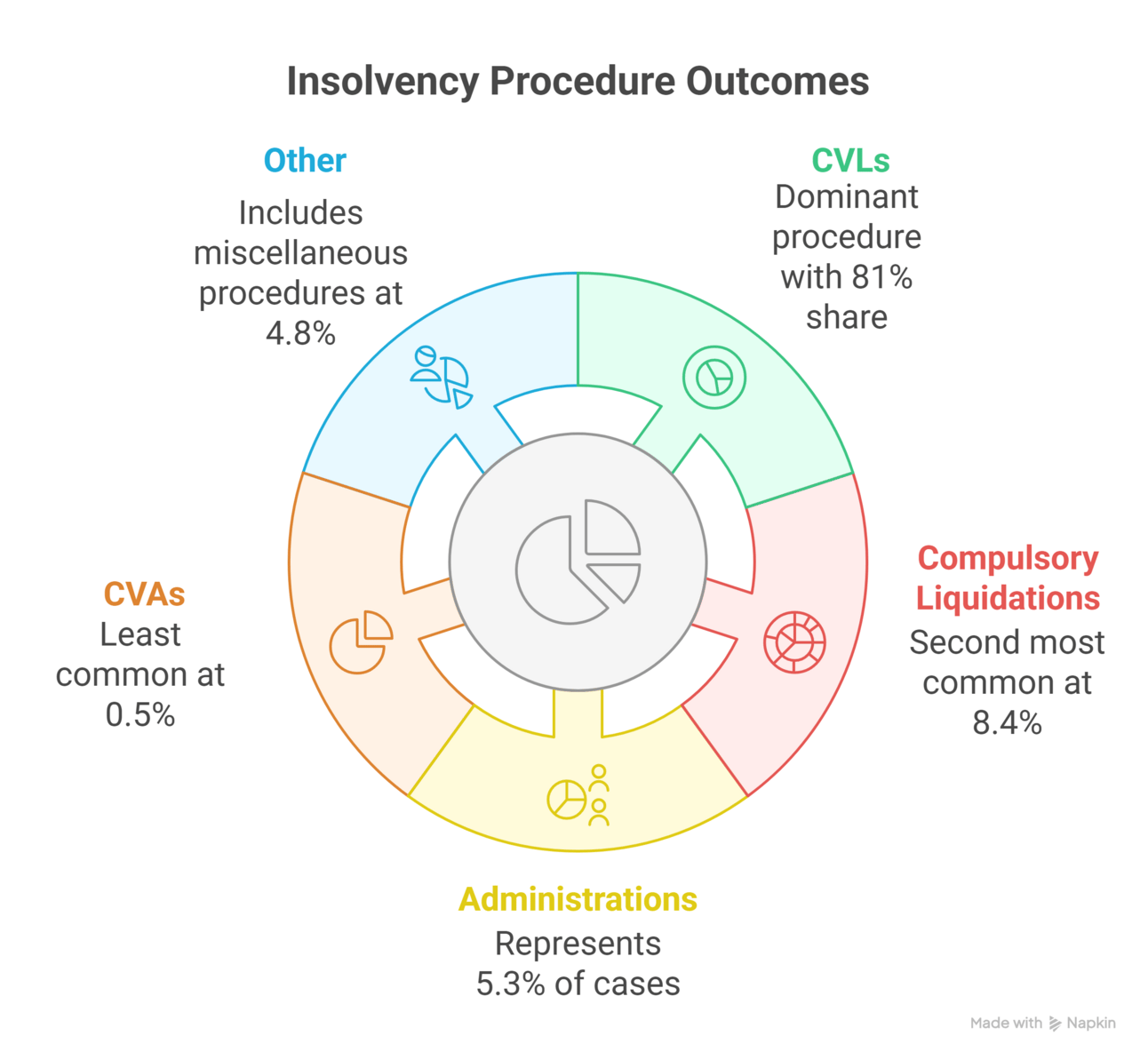

The numbers don't lie. In 2022, CVLs made up over 81% of all insolvencies – the highest number since records began. By comparison, potentially rescue-oriented options like administration and CVAs represented just a small fraction of cases.

The SME Survival Puzzle: Why Aren't CVAs Working?

One of the most significant findings in the Keay and Walton research concerns Company Voluntary Arrangements (CVAs). These were specifically designed with small and medium enterprises in mind, offering a more accessible alternative to the costly schemes of athe rrangement process.

The data shows CVAs never really took off. Even after the Insolvency Act 2000 introduced temporary protection from creditors for eligible companies proposing CVAs (giving them breathing space from creditor actions), the numbers didn't significantly increase.

What explains this consistent underutilization? The research identifies several possible factors:

Until 2003, the absence of this protection period for all companies might have limited uptake

When creditor protection became available, it was limited to certain companies

After HMRC regained partial priority status in 2020, the government may have been less supportive of CVAs

The rise of pre-packaged administrations ("pre-packs") might have offered a more straightforward path, allowing businesses to shed historical debt

Many companies simply may not be viable candidates for rescue

Most interesting is that in 2022, despite new standalone debt relief options introduced by the Corporate Insolvency and Governance Act 2020, CVA numbers fell to just 111, lower than in the early 1990s. This suggests small businesses are still not finding rescue paths when faced with financial distress.

Why Aren't More Companies Being Rescued?

The research poses a challenging question: Is it possible that many companies entering insolvency are simply not viable candidates for rescue? Perhaps they:

Have few or no assets to form the basis of a restructuring

Rely heavily on loans and factoring with little equity cushion

Have business models that can't adapt to changed economic circumstances

Face problems too severe for the available rescue procedures to address effectively

The authors suggest that despite good intentions, our current system may already be "as good as it can get" – offering rescue options for those companies where rescue is genuinely possible.

Economic Waves and Insolvency Patterns

The study shows that economic conditions dramatically impact insolvency patterns. During recessions, liquidations predictably spike. After the 2008 Global Financial Crisis, we saw the highest number of liquidations on record (until recently) – 19,077 in 2009.

Even more dramatically, the COVID-19 pandemic created unprecedented patterns. Government support initially suppressed insolvency numbers, but as that support was withdrawn, we saw CVLs spike to their highest level ever in 2022 (18,821).

This suggests a hard truth: many businesses exist in a precarious state where external economic shocks can quickly push them beyond rescue.

The Evolution of Corporate Insolvency Regimes

The research divides the analysis into four time periods, each marked by significant legal developments:

Pre-1987: Liquidation dominated, with few alternatives for insolvent companies

1987-2002: Introduction of administration and CVAs through the Insolvency Act 1986

2003-2019: Enterprise Act 2002 reforms allowed out-of-court administration appointments

2020-2022: Corporate Insolvency and Governance Act 2020 introduced new options during COVID

Each new reform brought hope for increased business rescue rates, but the persistence of liquidation as the dominant outcome raises serious questions about whether legal frameworks alone can overcome economic realities.

The Hidden Story: Dissolutions vs. Formal Insolvencies

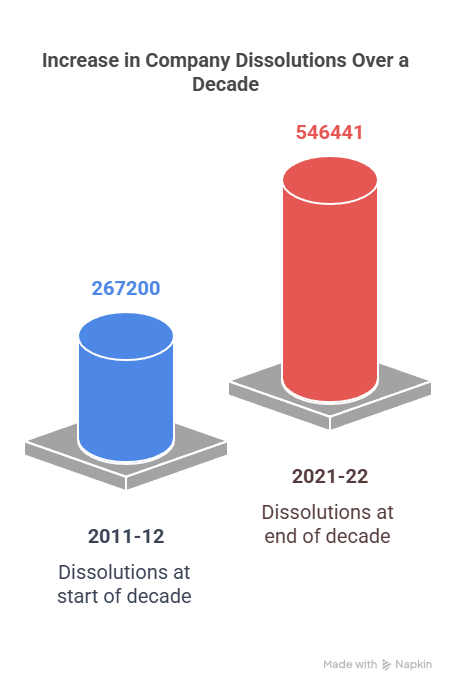

Another interesting finding from the research concerns the dramatic increase in company dissolutions. Since 2011-12, the number of dissolutions has jumped from 267,200 to 546,441 in 2021-22 – far outstripping the number of annual insolvencies.

This suggests an additional issue: some directors may be avoiding formal insolvency processes by allowing their companies to be struck off the register. This practice circumvents investigation by an insolvency practitioner or the official receiver, potentially concealing misconduct.

Recent legislation – the Rating (Coronavirus) and Directors Disqualification (Dissolved Companies) Act 2021 – aims to address this issue by making it easier to disqualify directors of dissolved companies. But it's too early to know if this will reduce dissolution numbers.

What This Means For Your Business

If you're running a company today, especially an SME, this research offers some important perspective:

Financial resilience matters. Building a strong balance sheet with sufficient assets and equity can create more options if difficulties arise.

Know the warning signs. The earlier you recognize financial distress, the more likely rescue options might work for your business.

Be realistic about viability. Sometimes, an orderly wind-down through CVL might be the most responsible option rather than prolonging inevitable failure.

Economic cycles are real. Plan for how your business would weather significant economic downturns or unexpected events like pandemic lockdowns.

Small companies need specialized solutions. The persistent low uptake of CVAs suggests current options may not truly meet SME needs.

Moving Forward

The authors conclude by suggesting it may be time for a "root and branch reconsideration of how our insolvency procedures should operate." With administration and liquidation increasingly converging in practice, perhaps we need a simplified system with a single gateway for distressed companies.

What's clear is that there's no magic wand for business rescue. Despite decades of policy intervention aimed at saving companies, the economic reality often proves more powerful than legal frameworks.

Until Next Time!

Navigate Public Sector with Ease

Doing business with the UK public sector just got easier. PublicSectorExperts cuts through the complexity, providing the insights and guidance your business needs. From procurement strategies to policy advice, their network of professionals ensures you stay ahead. Plus, you’ll enjoy connecting with experts who make it simple and actionable for your success.

Quick Question!

Before you go, we’d love to know how today’s Focus resonated with you. Your feedback helps us improve each issue. 😊

New here? Welcome aboard! Join the Focus community to get insights straight in your inbox.

Need help standing out? Let us spotlight your business or service and partner with us.

Got a tip, question, or big win? We’re listening! Share it with us, and we’ll see it featured.

Looking for expert advice? Our team of public sector pros has your back, get in touch here.

Reply